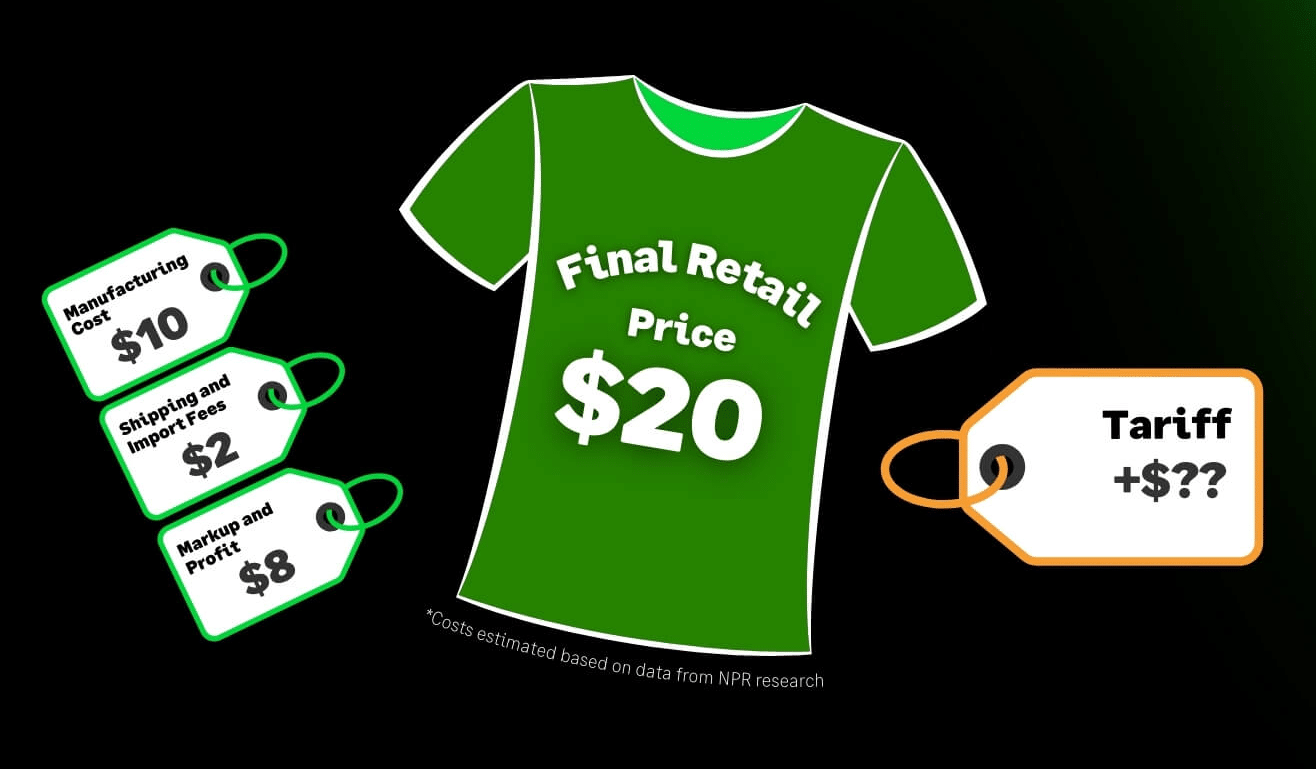

The prices of just about everything we buy have been creeping upward for years due to inflation, but another factor is starting to push prices even higher: President Donald Trump’s tariffs on imported goods. The United States imports more than $3 billion worth of goods each year, more than any other country in the world, and almost all of that is poised to get more expensive. To put the impact of the Trump tariffs into perspective, the team at Brightpearl decided to take a look at how these new levies are set to affect clothing prices, using the example of a typical $20 T-shirt you might buy at your favorite retailer. While the exact numbers are constantly changing as new executive orders are issued and new trade agreements are reached, here’s what we came up with as of Aug. 1, when Trump announced the latest tariff rates for dozens of countries all over the world.

Copy the code to embed this infographic on your website

Understanding the Trump Tariff Plan

What Exactly Are Tariffs, and Why Is Trump Imposing Them?

Simply put, a tariff is a tax on goods imported into a country. This tax is levied on the goods themselves and paid by the businesses importing them. Tariffs can be imposed for a variety of reasons, from raising income for the federal government to creating a political bargaining chip to use against other countries. Trump’s stated goal in imposing new tariffs is to close the gap between how much the U.S. imports and how much it exports: While we’re the world’s #2 exporter, we import more than we export.

Are Trump’s Tariffs Reciprocal?

While the White House has been calling these new tariffs imposed by Trump “reciprocal tariffs,” that’s not an accurate description of what they are. A reciprocal tariff is one that equalizes the tariffs between two countries. For example, if our tariff on Country X’s goods was 10% but their tariff on American goods was 15%, a reciprocal tariff would raise our tariff on Country X’s goods to 15%. That’s not what’s happening with Trump’s tariffs: Rather, the new tariff rates will be far higher than the rates those nations charge to import American goods.

When Do Trump’s Tariffs Take Effect?

The Trump tariffs were scheduled to go into effect in early August, though some of the impact won’t be felt right away. That’s partly because some retailers have stockpiled products in order to avoid paying the new tariffs for as long as possible, delaying the need for them to raise their prices. Also, Trump’s tariffs won’t be applied to goods that are shipped by Aug. 7, as long as they arrive in America by Oct. 5.

How Will the Trump Tariffs Affect You?

Clothing Prices Are Heading Up

Those $20 T-shirts are about to become a thing of the past. The lion’s share of America’s clothing imports come from Asian countries like China, Vietnam, India, and Bangladesh, all of which are subject to Trump’s tariffs, meaning that the cost of apparel is headed upward. In fact, research by the Yale Budget Lab shows that in the short run, consumers will be facing a 38% increase in clothing prices and a 40% increase in shoe prices.

Shoppers will likely change how much they buy and where they buy imported goods from in response, shifting their purchases to goods from places with lower tariffs. For instance, the United States-Mexico-Canada Agreement, enacted in 2020, shields many Mexican and Canadian imports from tariffs. However, Yale’s data shows that once shoppers adjust their buying habits, prices are still expected to settle at an average of 17% more for apparel and 19% more for shoes.

Broader Impacts Lie Ahead

The Budget Lab’s research also found that the overall effective tariff rate for all imports is expected to average 18.3%, the highest it’s been since the middle of the Great Depression. (By comparison, the average effective tariff rate in January 2025, before the first Trump tariff announcement, was 2.4%.) Once buyer behavior adapts to the higher prices, we’re still likely to be facing an average effective tariff rate of 17.3%.

As a result, in the short run, prices for imported retail goods are set to increase by 1.8%: This equates to a loss in income of $2,400 per household. In the longer term, price increases are predicted to settle at 1.5% overall, a loss of $2,000 per household.

In addition, the effects of the Trump tariffs on stocks may further bruise Americans’ wallets due to stock market volatility. As investors pull back and global markets weaken, instability on Wall Street could easily shrink Americans’ retirement funds and drag down the broader economy.

While it remains to be seen exactly where the new tariffs will leave us in the long term, what we do know is that in times like these, smart planning is crucial to the success of retail businesses. When economic conditions are uncertain, Brightpearl’s enterprise resource planning and inventory management capabilities can help you weather the storm. Take advantage of advanced retail analytics and demand forecasting and you’ll be one step ahead of the competition. Reach out today and book a demo to see what Brightpearl can do for your business.

Analyzing the Current and Future Price of an Average T-Shirt

| Pre-Tariff Breakdown: What Goes Into the Price of a T-Shirt? | |

| Manufacturing Cost | $10 |

| Shipping and Import Fees | $2 |

| Markup and Profit | $8 |

| Final Retail Price | $20 |

*Costs estimated based on data from NPR research

Where Does That T-Shirt Come From?

Much of the apparel that is available to American consumers is manufactured in other countries and imported. China (27%), Vietnam (13%), India (9%), and Bangladesh (6%) are the top apparel exporters to the United States, accounting for 55% of all clothing imports.

Estimated Cost of a Formerly $20 T-Shirt From Top U.S. Apparel Sources

Assuming no change in the manufacturing, shipping, and markup costs of a T-shirt, how much will that $20 shirt sell for once the tariffs are fully in place? While the White House’s plans for new tariffs are in flux, here’s a Trump tariff chart showing how much a formerly $20 T-shirt is likely to cost:

| Country | Manufacturing Cost | Existing Shipping and Import Fees | Markup and Profit | Projected Additional Tariff in Fall 2025 (as of 8/1/25) | Added Cost Due to New Tariffs | Final Retail Price in the U.S. Market |

| Bangladesh | $10 | $2 | $8 | 20% | $2.00 | $22.00 |

| Brazil | $10 | $2 | $8 | 50% | $5.00 | $25.00 |

| Cambodia | $10 | $2 | $8 | 19% | $1.90 | $21.90 |

| China | $10 | $2 | $8 | 34% | $3.40 | $23.40 |

| El Salvador | $10 | $2 | $8 | 10% | $1.00 | $21.00 |

| Guatemala | $10 | $2 | $8 | 10% | $1.00 | $21.00 |

| Honduras | $10 | $2 | $8 | 10% | $1.00 | $21.00 |

| India | $10 | $2 | $8 | 25% | $2.50 | $22.50 |

| Indonesia | $10 | $2 | $8 | 19% | $1.90 | $21.90 |

| Italy | $10 | $2 | $8 | 10% | $1.00 | $21.00 |

| Japan | $10 | $2 | $8 | 15% | $1.50 | $21.50 |

| Laos | $10 | $2 | $8 | 40% | $4.00 | $24.00 |

| Malaysia | $10 | $2 | $8 | 19% | $1.90 | $21.90 |

| Mexico | $10 | $2 | $8 | 0% | $0.00 | $20.00 |

| Myanmar | $10 | $2 | $8 | 40% | $4.00 | $24.00 |

| Nicaragua | $10 | $2 | $8 | 18% | $1.80 | $21.80 |

| Pakistan | $10 | $2 | $8 | 19% | $1.90 | $21.90 |

| Philippines | $10 | $2 | $8 | 19% | $1.90 | $21.90 |

| Sri Lanka | $10 | $2 | $8 | 20% | $2.00 | $22.00 |

| Taiwan | $10 | $2 | $8 | 20% | $2.00 | $22.00 |

| Thailand | $10 | $2 | $8 | 19% | $1.90 | $21.90 |

| Turkey | $10 | $2 | $8 | 15% | $1.50 | $21.50 |

| Vietnam | $10 | $2 | $8 | 20% | $2.00 | $22.00 |

Where Do Top Apparel Brands Source Their Products From?

| Brand | Sources Their Clothing From |

| Nike | Vietnam, China, Indonesia, Thailand |

| VF Corporation (Vans, The North Face, Timberland) | China, Vietnam, Cambodia, Indonesia, Mexico, U.S. |

| PVH Corp (Calvin Klein, Tommy Hilfiger) | China, Vietnam, Bangladesh, India, Sri Lanka |

| Skechers USA | Vietnam, China, Indonesia, Cambodia |

| Tapestry (Coach, Kate Spade, Stuart Weitzman) | China, Vietnam, India, others |

| Ralph Lauren | China, Vietnam, Bangladesh, Mexico, others |

| Levi Strauss & Co. | Mexico, Central America, China, Bangladesh |

| Under Armour | Vietnam, China, Bangladesh, Indonesia |

| Hanesbrands | Honduras, El Salvador, Bangladesh, Asia |

| Crocs | Vietnam, China, Indonesia, Mexico |

Sources:

https://fortune.com/ranking/fortune500/sector/apparel/

https://www.npr.org/transcripts/250747279

https://www.whitehouse.gov/wp-content/uploads/2025/04/Annex-I.pdf

https://coresight.com/research/mapping-the-us-reciprocal-import-tariffs-which-nations-are-affected/

https://passportglobal.com/us-tariff-rates-by-country-2025/

https://www.tradecomplianceresourcehub.com/2025/07/31/trump-2-0-tariff-tracker/

https://www.bbc.com/news/articles/c5ypxnnyg7jo

https://www.oberlo.com/statistics/most-valuable-fashion-brands

https://shenglufashion.com/2025/03/01/vf-corporations-evolving-apparel-sourcing-base-2023-2024/

https://worldscorecard.com/world-facts-and-figures/us-tariffs-and-the-world/

https://www.cnbc.com/2025/04/02/trump-reciprocal-tariffs-countries-chart-imports-united-states.html

https://gitnux.org/t-shirt-industry-statistics/

https://www.trade.gov/summary-cafta-fta-textiles

https://www.cnn.com/2025/07/22/business/trump-philippines-trade-deal