What is work in process inventory?

Source: accountingplay.com

Work in process (WIP) inventory is a term used in production and supply chain management to refer to any materials or components that are waiting to be assembled into finished goods. When raw material inventory has been combined with direct labor but is not yet ready to be sold, it counts as WIP inventory.

The value of your WIP inventory is the total cost of unfinished goods currently in production. This includes the cost of raw materials, labor, and overheads needed to manufacture the finished product. WIP inventory is considered an asset on a company’s balance sheet.

Let’s see how work in process fits into the different categories or stages of inventory.

3 Types of inventory

Your company’s balance sheet needs to list all the types of inventory you hold, from the raw materials to the finished products.

Raw materials

Raw materials are parts or components needed to manufacture a product. These might be sheets of metal for manufacturing vehicles, timber for property construction, or bales of fabric for clothing. Or they may be products in their own right, such as nuts and bolts for the vehicles, or buttons and thread to make the clothing. Once the manufacturer starts the production process, those items are no longer raw materials.

WIP inventory

Work in process inventory covers all the parts in the stage between raw materials inventory and finished goods inventory. For example, if you sell fancy boxes of candy online, your WIP inventory would include the boxes and inserts, the candy itself, the cellophane wrap, the labels, and the packaging for shipping. The components might be on a conveyor belt, or waiting in a queue for further processing.

The value of WIP inventory is often not the final amount, as costs for storage and transportation are added later. Since it takes up storage space and isn’t yet ready to be sold for a profit, businesses usually try to minimize the amount of WIP inventory they have on hand.

Finished goods

Finished goods are assembled materials that have undergone full production and are now ready to be sold. For example, the bale of fabric, the buttons, and the thread have been turned into a batch of summer dresses.

The total value is transferred to your finished goods account and eventually to the cost of sales. Sold items are referred to as “merchandise” and the associated costs are now considered part of the Cost of Goods Sold (COGS). Because WIP is time-consuming to calculate, most companies try to ensure that most of their inventory becomes finished goods before the end of a reporting period.

Work in process Vs. work in progress inventory

WIP can stand for two similar terms: “work in process” and “work in progress”. The two are often used interchangeably, and businesses selling physical products might use them to mean the same thing, but it’s important to understand the subtle differences.

As we’ve explained, work in process describes the stage where raw materials are converted into finished goods. It’s typically used for production operations that can be completed in a short period of time, such as a small bakery creating 20 batches of cupcakes.

Work in progress inventory is more often used for large-scale production over a longer duration, like a construction project. It tracks how much the project is costing compared to the percentage toward completion. Work in progress is also used by companies offering services rather than just products.

Why is work in process inventory important?

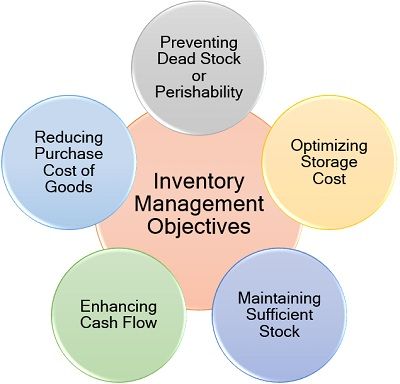

Yes, monitoring your WIP inventory can be tedious, but it’s essential for effective inventory management and to check how well your supply chain is performing. Any business should always be aware of exactly what it has in stock at every stage of inventory, including WIP.

Source: wallstreetmojo.com

You might assume that WIP largely applies to manufacturing companies, but it’s just as important for retailers to keep an eye on it. That’s especially if you sell custom or hand-made goods, source materials from multiple suppliers and send them to a manufacturer for assembly, or work with a partner who sources materials and assembles finished goods for you.

Inventory visibility gives manufacturers a better idea of how much needs to be produced, and also helps with demand forecasting. For retailers, getting this information from your suppliers will reveal the optimum times to order goods, and ensure you don’t promise customers what you can’t deliver.

You can also decide if you need to minimize your WIP inventory, since a large amount of capital is tied up in items waiting to be sold. It also takes up storage space and increases holding costs, as well as the risk of materials getting lost or damaged before assembly. That said, you might want to hold WIP inventory as safety stock to guard against shortages or spikes in demand.

WIP is also a significant factor in the valuation of your business, so you should include it as an asset when seeking investors or securing financing. Calculating WIP inventory also helps you understand the true value of your inventory for tax purposes.

What is the role of work in process inventory in the supply chain?

The supply chain is a fragile thing. It can easily grind to a halt if there’s a delay in one section, including the assembly of finished goods. This means that manufacturers, suppliers, and retailers need to work together to ensure the work in process stage runs smoothly.

With a clear understanding of the WIP inventory process, you can identify and improve inefficiencies. For example, as a retailer, you need to know that your chosen supplier stays on top of WIP levels by optimizing labor and production processes, in order to give you the shortest lead times and lowest prices.

It makes sense to carry as little WIP inventory as possible. If materials wait around too long and become obsolete or spoiled, it will cause problems in the supply chain. When WIP inventory remains consistent, or you’re able to keep low stocks without losing out on sales, it’s an indication that your production operations are working efficiently.

If you have excess WIP inventory without any growth in sales, meanwhile, there may be bottlenecks in the manufacturing or procurement process. For this reason, it’s important to work closely with your partners to obtain accurate projections of lead times (which you can do with Brightpearl’s supplier management technology).

How to calculate work in process inventory

The cost of WIP inventory isn’t just about determining the value of finished goods—it also involves associating a cost with a percentage of completion. This can be time-consuming, so it’s good practice to tally it up at the end of your accounting period for less uncertainty on your balance sheet. Most companies also try to minimize WIP inventory before reporting.

In most cases, the WIP inventory value includes raw materials, labor, and factory overheads, although it can also include wages and subcontractor costs for bigger operations.

Work in process inventory formula

Most businesses calculate their work in process inventory at the end of the accounting period (such as a quarter or year). The figure you’re trying to find is called the “ending WIP inventory”.

Here are the variables you need to calculate WIP inventory. In the next section, we’ll show you how to calculate them.

Beginning WIP inventory: The ending work in process inventory for an accounting period is also the beginning work in process inventory for the next accounting period. So, if you do quarterly reporting, you’ll need to know the ending WIP inventory for the previous quarter, which is carried over as the beginning WIP inventory for the coming quarter.

Production costs: This is the total cost of the raw materials, labor costs, and overhead costs (such as costs for operating machinery). The more WIP inventory that goes through the production process, the higher these costs will be, which will impact the total cost of manufactured goods.

Finished goods: This is the total value of goods that have been manufactured and are ready to be sold. It encompasses all the costs incurred during the creation of the final product.

How to calculate beginning work inventory

Take a look at the asset section of your balance sheet for the previous accounting period, and find the ending WIP inventory. This WIP figure is also your beginning work in process inventory for the new period.

It’s calculated from the cost of goods sold (COGS), plus the ending inventory balance, minus the cost of purchases. If you’re a new business and you don’t have an ending inventory balance from a previous accounting period, just subtract the cost of purchases instead.

COGS + Ending WIP Inventory – Cost of Purchases = Beginning WIP Inventory

As well as the beginning WIP inventory, you also need to know your production costs, or manufacturing process costs. The formula for this is:

Raw Materials + Direct Labor Costs + Manufacturing Overhead = Manufacturing Costs

Finally, you can work out the value of your finished goods, or the cost of goods manufactured (COGM). Add your total manufacturing costs to your beginning WIP inventory, then subtract the ending WIP inventory, giving you the total COGM:

Total Manufacturing Costs + Beginning WIP Inventory – Ending WIP Inventory = COGM

How to calculate ending work in process inventory

Once you’ve calculated your beginning WIP inventory, production costs, and cost of finished goods, you can figure out how much ending WIP inventory you have. This will be listed as a current asset on your company’s current balance sheet.

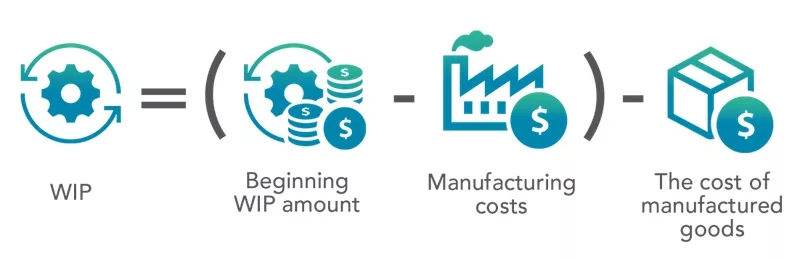

The formula for calculating WIP inventory is:

Beginning WIP Inventory + Production Costs – Cost of Finished Goods = Ending WIP Inventory

Source: investinganswers.com

Examples of work in process inventory calculation

Just to make things crystal clear, we’ll show you some examples of WIP calculations.

Imagine your business has a beginning WIP inventory worth $120,000. During the following accounting period, your production costs are $160,000. The total cost of your finished goods is $260,000.

Beginning WIP Inventory + Manufacturing Costs – Cost of Finished Goods = Ending WIP Inventory

So, that’s $120,000 + $160,000 – $260,000 = $20,000

The ending WIP inventory would be $20,000.

Or, taking our earlier example of a business selling candy boxes, let’s say you start the accounting period with $60,000 worth of candy, boxes, cellophane wrap, labels, and packaging ready to be assembled (the beginning WIP inventory). It then costs your business $150,000 to put the boxes together. The cost of the finished goods comes in at $200,000.

So, that’s $60,000 + $150,000 – $200,000 = $10,000

In this scenario, your ending work in process inventory would be $10,000.

We should point out that the ending WIP inventory cost is actually just an estimate. That’s because there are certain factors that aren’t included—such as account waste, scrap, spoilage, downtime, and maintenance, repair, and operations (MRO) inventory.

If you wanted to make this figure 100% accurate, you’d have to itemize every single factor in the production process, which would take far too long and wouldn’t be a productive use of your staff’s time. But even an estimate helps you get a good handle on your WIP inventory.

How to optimize your inventory management (& more) with work in process inventory

Although WIP inventory is only one part of your business’s total inventory, keeping on top of it can help you maintain a complete overview of your assets and operations. You can then make better decisions and forecasts, as well as identifying areas for improvement. (Hint: For all of that, you’ll need some smart software.)

Source: theinvestorsbook.com

Get a more accurate value for your business

WIP inventory counts as a current asset, so it’s essential to include it on your balance sheet. If not, your total inventory will be undervalued and the cost of your finished goods will be overstated. By tracking WIP inventory, you’ll get an accurate breakdown of what your inventory is actually worth.

This is not only necessary for tax purposes, but is also helpful in the event that you decide to sell the business, seek investment, or consider expansion. Understanding your WIP inventory lets you set benchmarks for comparing annual growth, while minimizing it helps you divert money elsewhere.

Spot possible errors

As with all types of inventory, keeping a watchful eye on WIP inventory makes it easier to spot problems and mistakes. For example, if the amount of WIP inventory you hold is getting steadily higher, you need to investigate bottlenecks in the production process before it affects other areas of the supply chain. This is especially the case for perishable items.

It’s no use taking a scattershot approach to tracking WIP. You need a robust system in place, which means a software solution that gives you full inventory visibility and analytics capabilities. That’s exactly what you get with Brightpearl’s retail operating system, which also comes with supplier management to help you coordinate the arrival of raw materials or finished goods.

Move away from hand-counting your inventory

Hand-counting is so last century. It’s time-consuming, prone to errors, and there’s no need for it—not when you can let technology take the strain.

For example, Brightpearl’s Automation Engine lets you carry out full or partial flexible inventory counts at the click of a button. You can tailor them based on anything from location and throughput to value and product attributes, and enable partial counts by zone.

The automated system has a bill of materials feature that tracks raw material inventory and automatically converts it into finished goods once assembled. It can also transfer inventory between warehouses, and track inventory in real-time using barcode scanning.

Accurate inventory counting enables more accurate forecasting, especially when coupled with Brightpearl’s integrated Demand Planner for data-driven demand forecasting and replenishment recommendations. All of which helps you communicate more efficiently with suppliers and shipping partners.

Final thoughts

Because it represents an “in-between” stage, classified as neither raw materials nor finished goods, work in process inventory can sometimes be overlooked. But it’s important that you keep track of and understand it.

By using the work in process formula to calculate WIP inventory, you can get an accurate value of your business, spot potential problems in the supply chain, and optimize inventory to minimize holding costs and errors.

Brightpearl gives you complete visibility into all your inventory, with automated cycle counts and instant updates across all your e-commerce platforms, marketplaces, and physical stores. It also helps retailers and suppliers work together for smoother operations.