Intense contention in retail forces traders to keep their eyes open and thoroughly monitor their rivals. To perform insightful competitor analysis, companies are increasingly using social media listening tools. This innovative software allows you to discover a deeper layer of data about competitors. You can better understand their strengths and weaknesses, detect threats to your brand, and reveal the best growth opportunities.

Importance of competitive analysis

Sound competitor analysis is the starting point for developing a successful business strategy. Without a clear understanding of your opponents and the balance of power in retail, you will have to act like a careless conqueror of uncharted territory.

It is naive to expect success until you have a detailed and constantly updated roadmap with all the pitfalls, obstacles, and threats you may encounter. Forewarned is forearmed, right? The better you understand the competitive landscape, the more chances you have to win.

Such an understanding is especially critical now, given the drop in sales retailers are currently experiencing due to the global market slowdown. According to NPD Group research, U.S. consumers have already reduced their number of purchases and plan to spend even less.

In addition, buyers are becoming more demanding in terms of customer service, prices, seamless shopping experiences, etc. This trend leads to more intense competition and fierce struggle for the customer.

New opportunities

To stay afloat amongst this rivalry, retailers should streamline their management by applying automation tools. But what is also vital–they need to clearly understand where exactly they win and where they lose when compared with opponents.

That’s why they are seeking new ways to upgrade their competitor analysis techniques. One such method is through social listening platforms, AI-powered tools that take market research to a fundamentally new level.

They provide access to actionable insights into competition in the retail market by deeply analyzing relevant customer conversations on social media.

This opportunity is really helpful as the customer’s perception of your company and your competitors are changeable and sometimes can surprisingly differ from yours.

Misunderstanding consumer sentiment and opinions can lead to poor business decisions. But, careful listening to prospects could be a decisive competitive advantage.

Traditional buyer surveys and interviews are not that effective, as the number of respondents is limited, and their answers are often biased, cursory, and insincere. Not to mention that polls are time-consuming. At the same time, social listening tools provide an instant global overview of genuine and unprompted customer opinions about you and your rivals in real time.

This way, you can accurately diagnose the buyer’s attitude towards many aspects–from pricing, quality of goods and assortment to customer service and loyalty programs.

Basic steps in competitor analysis

Before diving into social media listening capabilities, let’s take a quick look at the basic components of competitive analysis. It usually includes the following steps.

1. Identify your competitors

Create a list of up to a dozen opponents and focus on direct competitors who offer similar products and services to the same target audience as you. But do not ignore indirect rivals who are aimed at the same audience, but differ in, say, assortment, price, distribution channels, etc. For example, online retailers are indirect competitors for brick-and-mortar stores.

2. Keep an eye on leaders

Determine each competitor’s market share, current earnings, and growth rate. Just because your brand isn’t at the top doesn’t mean you should limit your competitive analysis to companies of the same scale as yours. Tactics of major market players can be applied to increase your presence in the market.

3. Compare your competitors’ products with the goods you offer

Consider indicators such as price, quality, variety of brands, and product items. Find out by what criteria your assortment is inferior to competitors’ and where you win.

4. Learn their sales techniques

Detect which sales channels your rivals are actively using: physical stores, online shops, various marketplaces, social media, etc. Try to find out if they use efficiency tools for multichannel selling.

5. Investigate communication style

Explore the channels of communication with customers. Perhaps a competitor is successfully using a social network that you underestimate.

6. Learn content strategy

What kind of content and how often is it delivered to consumers through a website, blog, social networks, or email newsletters? Analyze how commercial offers and calls to action are integrated into them.

7. Become a ‘mystery shopper’

Subscribe to competitors’ mailing lists, call their sales managers, find out the cost and speed of delivery, and go to their physical stores to get to know competitors “from the inside”.

8. Discover how they manage loyalty

Track how they use discounts and sales and what loyalty programs they offer. Look into how flexible their payment options are.

9. Figure out how they deal with the supply chain crisis

Find out how they are solving the supply chain problems that the retail market has been facing lately.

10. Get the full picture of their shopping experience

Learn what tricks are used in online commerce to improve the shopping experience: 3D views of products, applications, voice assistants, subscription membership, “buy online, pickup in-store” models, etc.

Social listening: аnother side of competitive analysis

Having taken the steps described, you will certainly receive a lot of helpful information. But still, you will hardly get a comprehensive answer to the main question of competitive analysis: why exactly do your customers go to competitors instead of you? You can only guess.

How about giving the floor to the consumers themselves? Instead of foisting tedious questionnaires on them, listen to what they are saying about you in their everyday lives.

A social listening tool provides a unique opportunity to get straight into the minds of consumers and find out what they really think and feel about your and your competitors’ products and services.

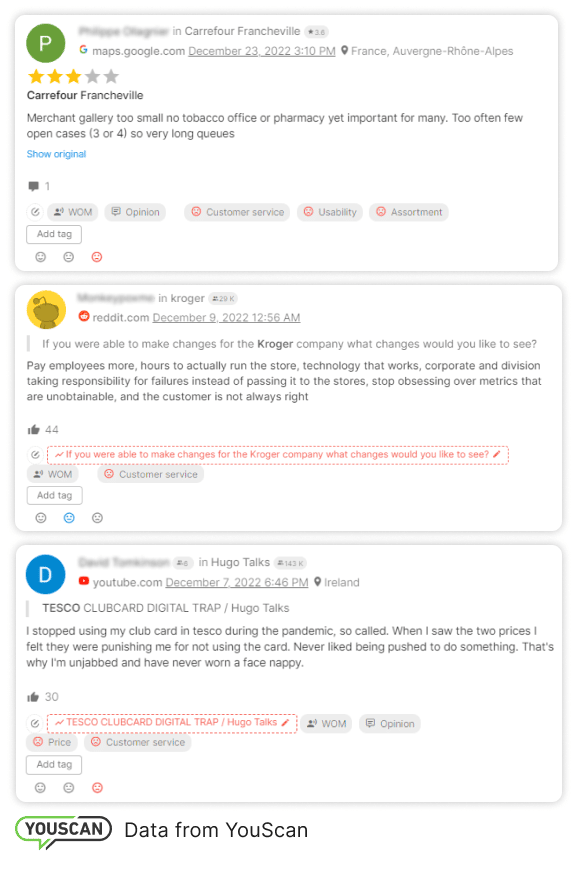

How does it work? The platform collects all mentions of the chosen brands from social media and other online channels and processes them with the help of AI. By applying flexible settings and filters, you can sort customer posts by different parameters and analyze them from various angles.

As a result, you get all the necessary data well structured and visualized in the form of graphs, patterns, and dashboards. Let’s have a look at the social media intelligence platform in action. For comparison, we have analyzed several leading retail brands.

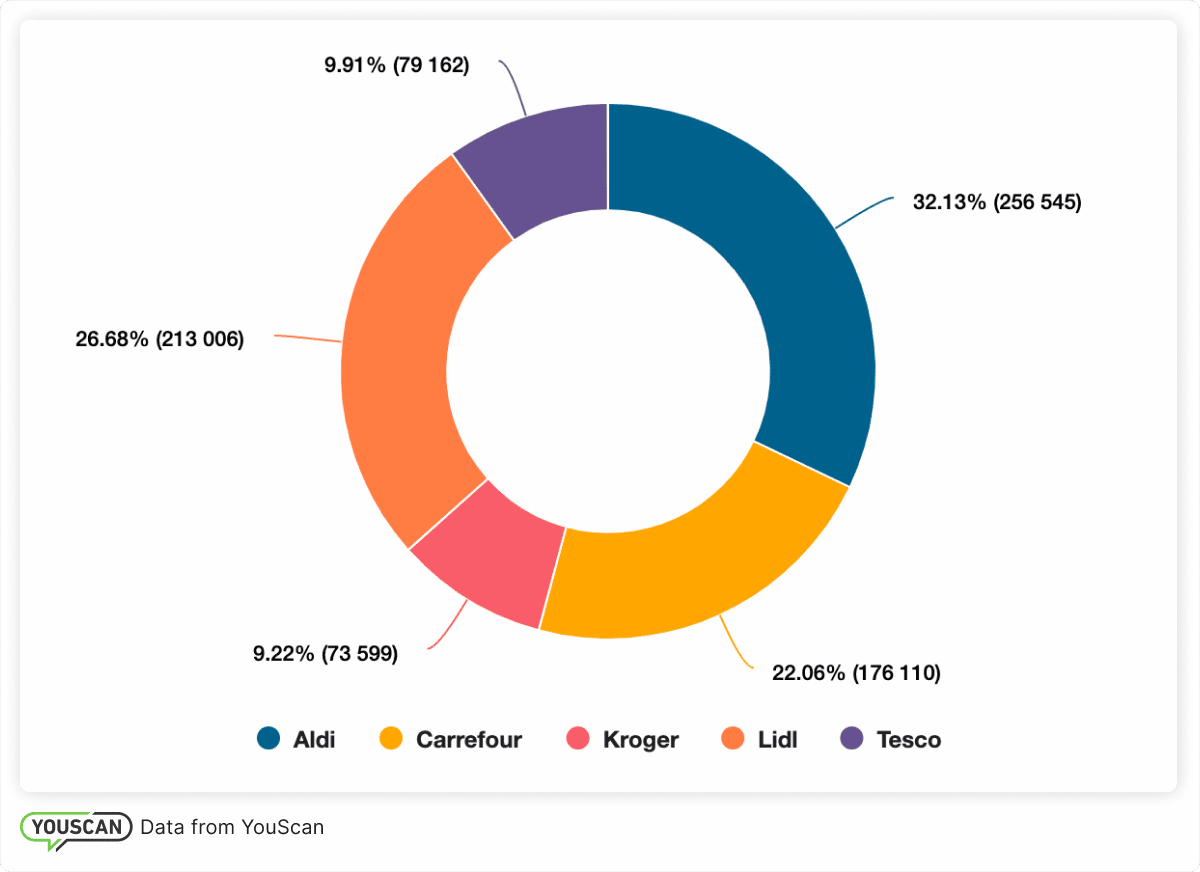

Share of voice

Source: YouScan

Share of voice (SoV) is one of the most basic metrics of any competitive analysis. Before the digital era, it was used to measure market share. But with the development of social media and other digital channels, the concept behind it shifted towards the percentage of discussions around your brand in comparison to other market players.

By applying this feature, you will find out how often consumers mention you online in comparison with competitors. You will get the exact percentage of discussions visualized in the form of a pie chart. Marketers consider a brand’s visibility in the digital domain to be an indirect but fairly accurate reflection of its actual market share. In this case, we can see that Aldi is in the lead, while Kroger is the least mentioned.

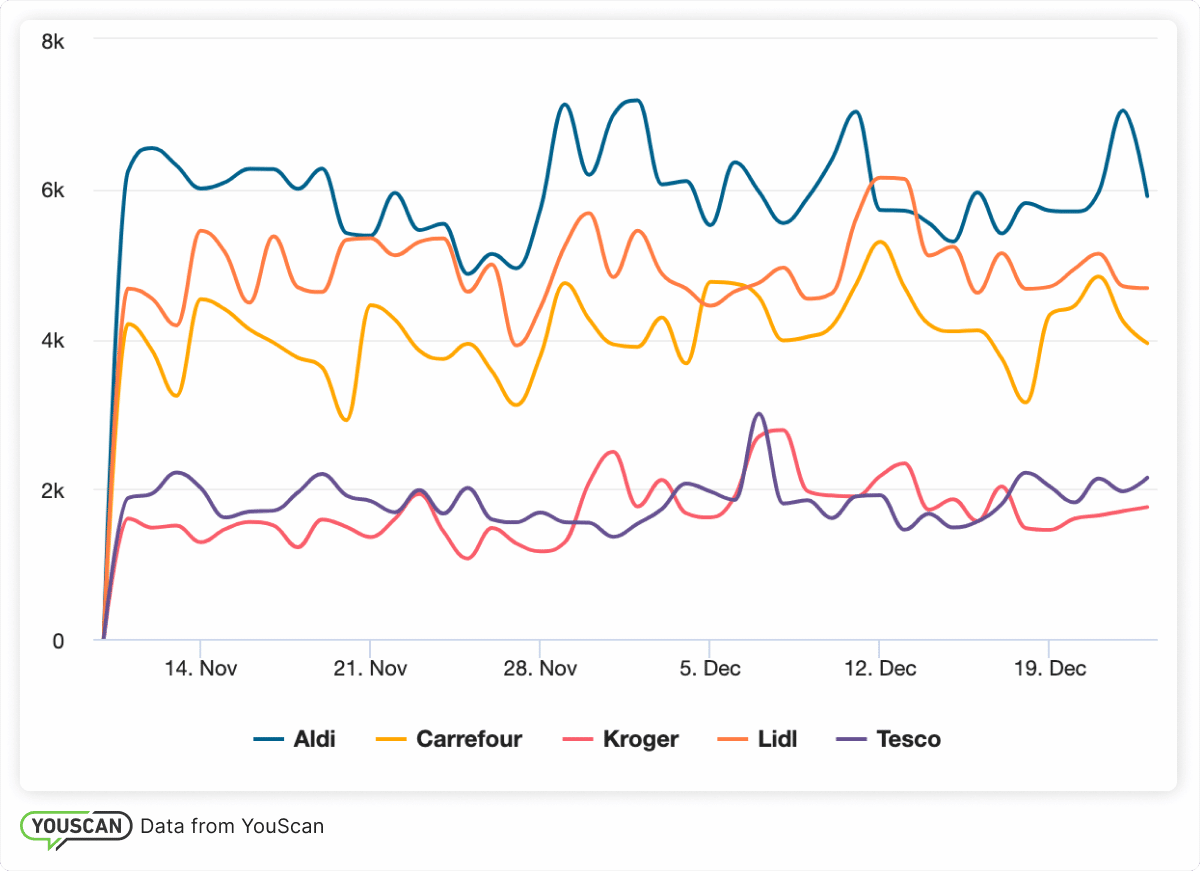

Number of mentions

Source: YouScan

You can also find out the exact amount of mentions for each selected brand in a set period of time. The platform will show you not only numbers but also graphs depicting the growth and decline of interest for each company.

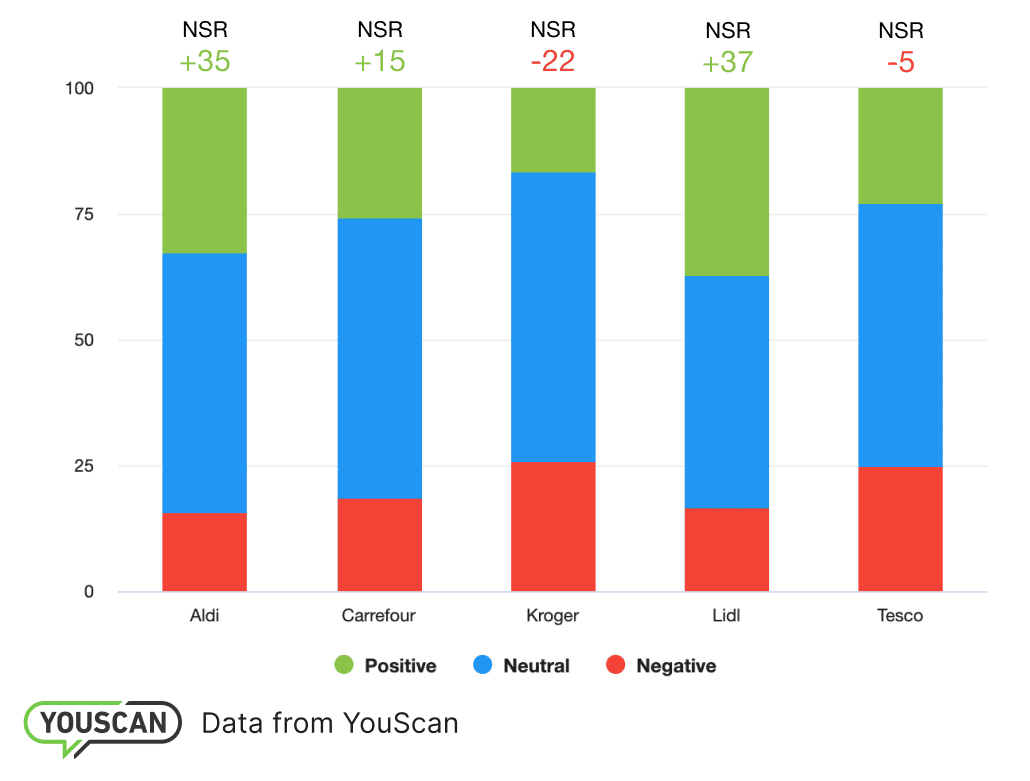

Sentiment

Source: YouScan

The number of mentions will reflect brand recognition in comparison with opponents. But more importantly, you can identify the prevailing mood of consumer posts. The tool will visually display the ratio of positive, negative, and neutral reviews.

It will also calculate each brand’s NSR (net sentiment rate) to understand better how your audience feels about your company versus your competitors. For Aldi, Carrefour, Kroger, Lidl, and Tesco, we have +35, +15, -22, +37, and -5 NSR, respectively.

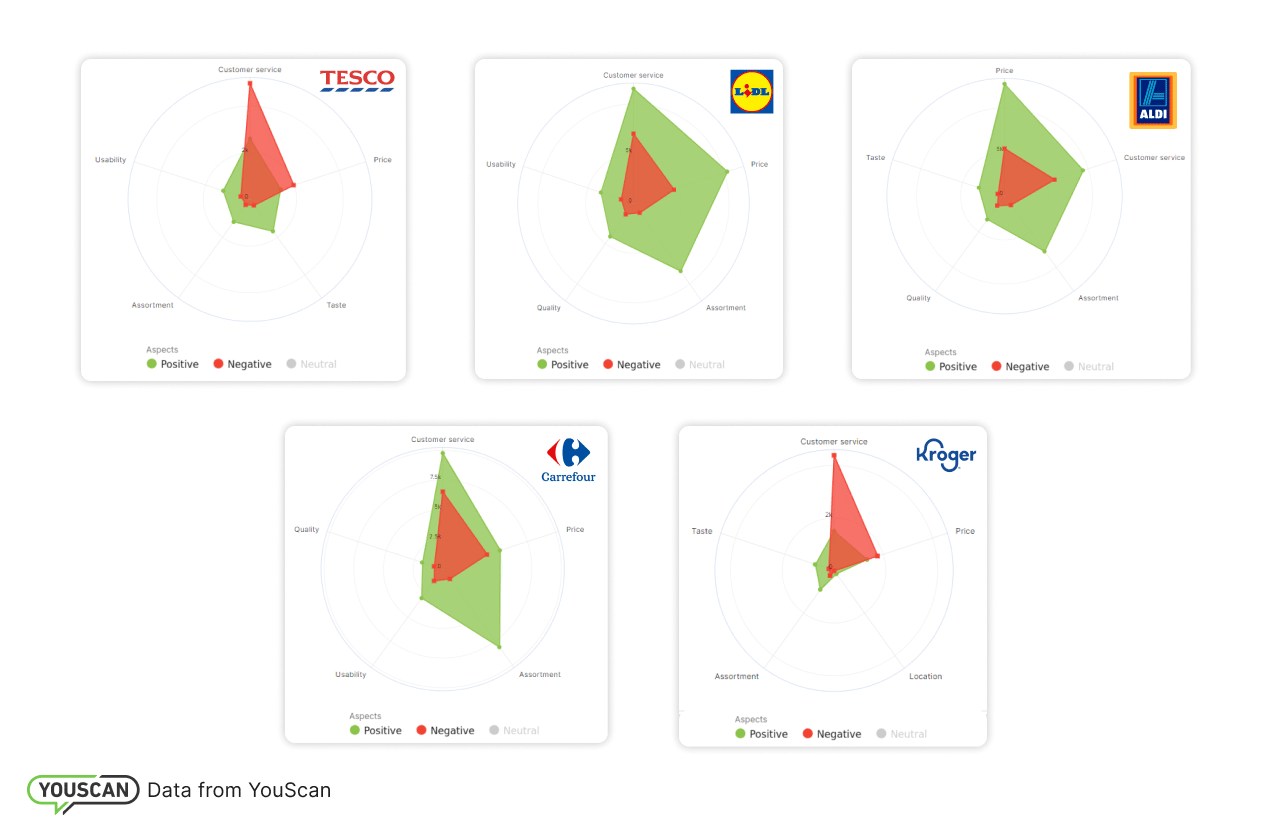

Know strengths and weaknesses

For more specific insights about customer attitudes to the brands, find out their sentiment on specific aspects. Select the characteristics you want to evaluate and the platform will design convenient charts with all the selected parameters.

Source: YouScan

As you can see, poor customer service frustrates customers of all brands. But Kroger and Tesco are the most criticized in this regard. By clicking on a specific aspect, you dive into a feed of all relevant user posts for more details.

Your opponents’ weaknesses can prompt you where you can outperform your rivals. Given the general disappointment with customer service, improving this aspect could be a great competitive advantage.

However, the price at Aldi and Lidl can be determined as their strength, so it might be a great time to improve your pricing offers and come up with special discounts to beat up your competitors.

Track trends

Using the social media listening platform, you can promptly track trends in consumer sentiment in relation to the retail market as a whole and to each specific brand.

Analytical graphs mark the most discussed topics, indicating the number of mentions and user engagement. This allows you to see what annoys customers the most and what is causing those worries.

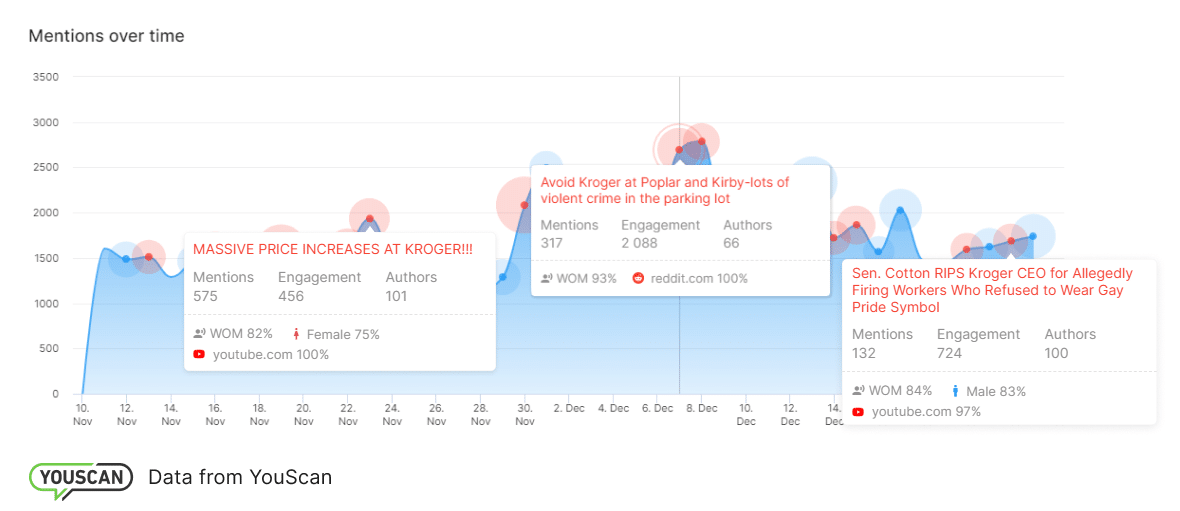

As for the most criticized retail chain, Kroger, the chart below reflects the topics that triggered the spikes in consumer mentions. Often, the most discussed topics have negative sentiment and serve as a kind of red flag for other market players, warning of possible troubles that may also threaten you.

Source: YouScan

In addition, by refining your search query, using filters, hashtags, and keywords, you can narrow your search to find consumer answers to particular questions.

Source: YouScan

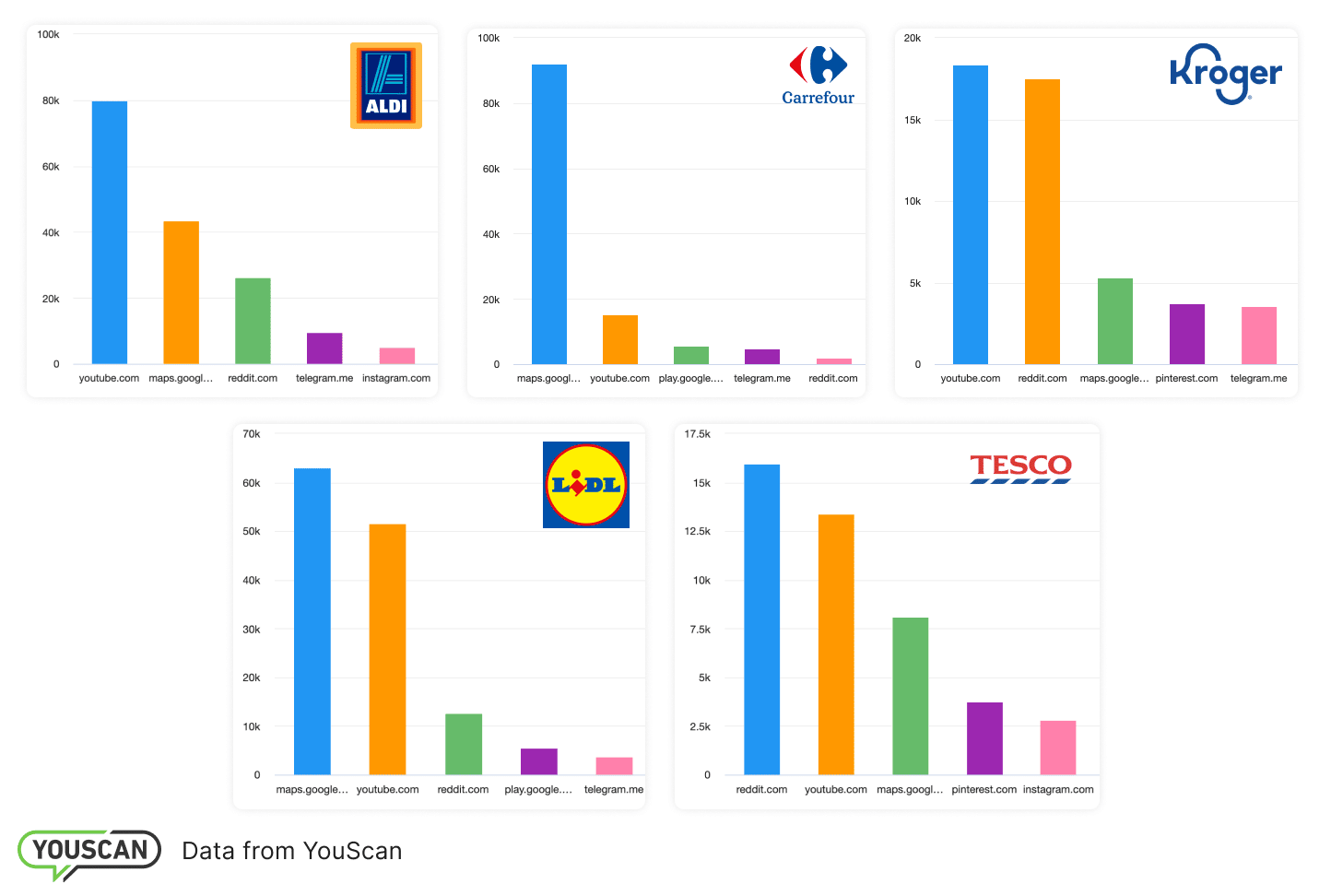

Identify top mention channels

Even though all of the listed companies are direct competitors, the social networks where they are most discussed can differ significantly from brand to brand. You can track where your audience and your competitors’ customers are most active, and which channels deserve your attention. Perhaps you underestimate some of them.

Below are the rankings of the most popular channels for the analyzed brands.

Source: YouScan

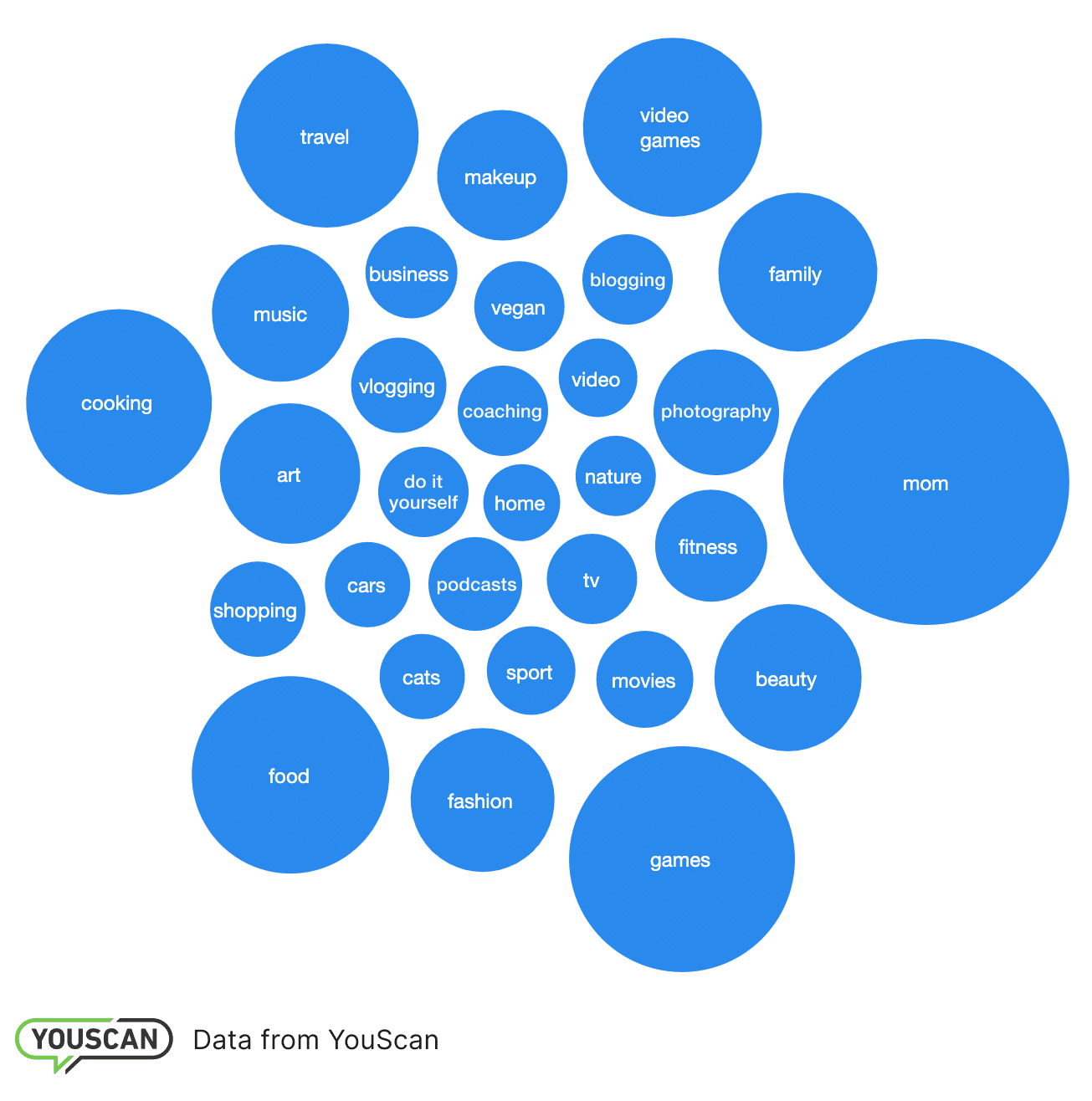

Get to know your audience

Advanced social media listening platforms also allow you to study the audience of brands in depth. You can define its demographics and determine the professions and interests of the most active buyers.

The interests of the analyzed brands differ slightly. The most active consumers are mainly engaged in motherhood, family, cooking, and traveling. It can be a great source of information when developing new ideas for marketing campaigns. In this case, a new campaign might feature a family that loves to spend time together, and enjoy cooking and trying out new cuisines.

Source: YouScan

Interestingly, among the prevailing interests, you can also find gaming. Perhaps this means that marketers should consider leveraging the metaverse and in-game shopping, as Nike has done.

Tips for using social listening

- Use the WOM (word of mouth) filter, which allows you to sort out customer opinions from promo posts and publications in the mass media.

- Create dashboards with the most critical metrics around your competitors, so you can instantly get access to the essential information and keep track of any changes on a regular basis.

- Use platforms with maximum channel coverage. The more channels you analyze, the more representative the results of your analysis will be.

- Take advantage of smart features like Auto Categories that help you to quickly find complaints, comparisons, and questions. This will allow you to get a full and detailed picture of how social media users are discussing your competitors.

- Choose platforms with advanced visual analytics capability. It allows you to collect posts by recognizing the brand’s logo in a picture without a text mention of a company. This makes the collection of relevant content much more productive.

Conclusion

Social media listening gives you a unique opportunity to analyze your competitors’ strengths and weaknesses compared to yours based on genuine customer attitudes. You can compare your audiences’ characteristics in detail, detect threats to your brand, take into account your opponents’ advances, failures, and mistakes, and see the most efficient ways to strengthen your own market position.