July’s retail data sees UK and US orders up, but average spending down as customers’ habits change. Here are the results at a glance:

- Total number of orders increased by around 20% compared to last year (July 2016)

- However, total order value increased by a more modest 4.4% in the UK and remains flat in the US

- Meanwhile, the average order value (AOV) drops by 13% in the UK and 15% in the US as customers decide to place more individual orders, more frequently

Now let’s take a look at these findings in more detail…

Customers are shaking up the market

Online retail is being shaped by the ever growing presence of the mobile customer and by the increasing impact of social media, which is significantly altering how customers want to interact with retailers. After checking out the performance of both the UK and the US market for the month of July 2017, it is clear that we’re seeing this change how customers are making online purchases – and more so now than ever before.

Should we be concerned, as average order value drops to under £50?

We looked at data for a sample of over 450,000 orders placed in July 2017 in the consumer and SMB space (i.e. excluding wholesale orders) to gain a better picture of how the retail landscape is being reshaped by today’s customers’ habits – and the conclusions are very clear indeed, with similar trends replicated in both the UK and the US.

In the UK, we witnessed a full 20% increase in the total number of orders placed when we compared it to like-for-like data for the same period of last year, and 21% in the US. However, although there was a double digit increase in the number of orders placed, the total order value only increased by 4.4% and in the US was even lower at just 0.2%. The UK data chimes with a recent report from KPMG, which stated that retail performance was stable in July, with around a 1.4% growth rate overall.

The KPMG report continues: “While online sales continue to outpace in-store growth, it is not one at the expense of the other. Successful retailers saw growth in the month across all channels as they make the most of their multi-channel proposition, with many upgrading their online offer to feed the trend of on-the-go shopping.”

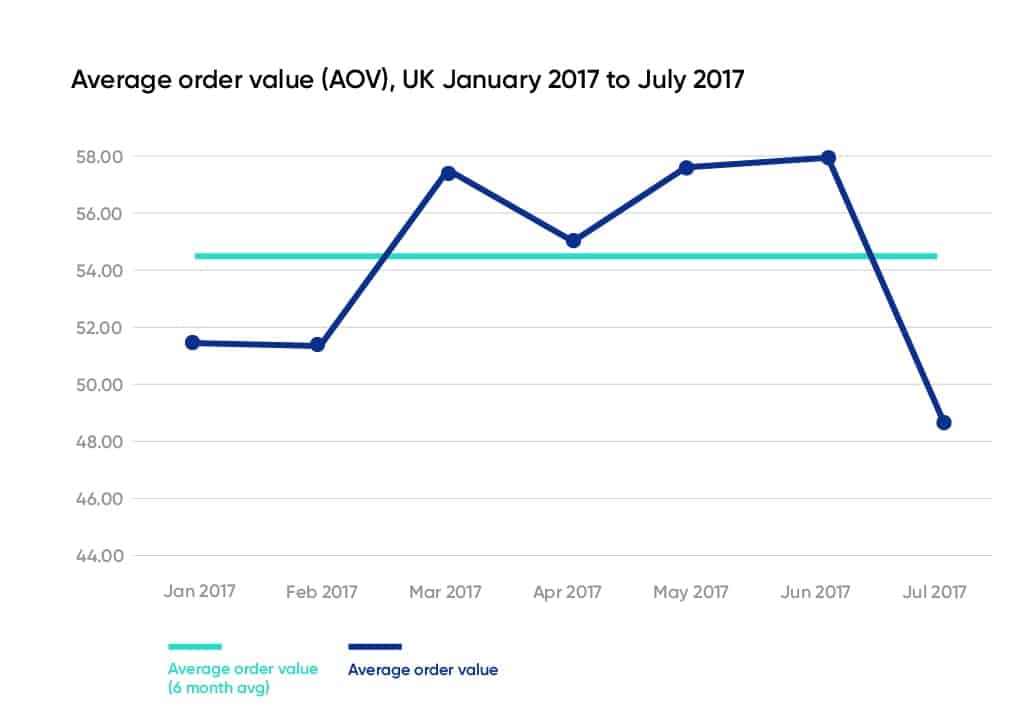

For the UK, this resulted in a drop in terms of the average order value from £55.71 to £48.67, equivalent to a decrease of 13% when compared to July 2016. Meanwhile, the decline in the US market was 15%. This means that in the UK market, it is the first time this year that the AOV has dropped under the £50 threshold:

The average order value for the first six months of 2017 was £54.75, meaning that July’s performance is trending at around 11% below the six-month average.

Why does this matter?

Average order value is a significant metric for retailers, as a decline in AOV can have an impact on profitability. So while retailers do not need to worry directly about a lower AOV as customers are still currently spending more, this change does put pressure on the business.

And not only does it show that customers are clearly modifying their behavior, our research shows that they are doing so at a rapid pace. As you’d expect, the figures show that the pace of change is currently faster in the US market than in the UK, but both are being impacted by the same trends.

The prevalence of mobile is driving quick, one-off, impulse transactions, which mean that, over time, dealing with an increasing deluge of individual order items could impact costs elsewhere. For example, it could result in a change in processing costs. Shipping costs may also need to be revisited depending on how the pricing structure compares to other competition in the market.

Moreover, online customers can be equally as fickle as customers in the offline world – if not more so. They are becoming well-versed in searching for the best online deals in the same way they might scour the High Street for the best prices. Investment in building mobile loyalty will need to be increased as this behavior becomes even more widespread.

One retailer that is poised to benefit is Amazon, which, as Business Insider points out, is leading the way in terms of online shopping, stating: “Amazon is well positioned to benefit from the shift to mobile shopping.” According to latest figures, 50% of US shoppers are now on its app. Indeed, Amazon’s footprint in mobile may be just one of a number of other reasons why this retailer is dramatically influencing habits, especially for the month of July.

What’s the Amazon effect?

On 12 July, Amazon held its annual Prime Day, which is having ever greater influence on buying patterns in the UK as it starts to enjoy some of the levels of popularity seen in the US. As we reported recently in our blog Retail Insights: Behind the Scenes During Amazon Prime Day, although more customers are being enticed to spend during the Prime Day sales, they are choosing to spend less individually, which also resulted in a 20% drop in average order value for Prime Day 2017, compared with 2016.

This becomes especially evident when we look at the monthly number of orders for Amazon, which was up by 41% in the UK, while the average order value for the period dropped from £18.33 to £14.89, a decrease of 19%.

What headwinds could retailers face?

While for the moment, the overall decline in AOV is not a cause for concern, it needs monitoring to ensure that vital customer buying signals and changes in behavior that need to be addressed are not missed.

A move to more frequent and lower value transactions suggests that customers are likely to shop around for cheaper deals on each individual transaction. This means more budget is needed in order to make the mobile buying journeys as efficient and optimized as possible, and more engagement with social media is crucial to build more trust for your brand.

Meanwhile, in the UK, the combination of higher processing or administration costs, combined with expected softness in consumer spending could create an even more difficult scenario in the coming months, making it more important to keep ahead of the trends to ensure that you are not taken off guard. As KPMG points out in the same article on July performance:

“Interestingly, July retail sales diverge from the latest consumer confidence figures, which noted a downturn in consumer sentiment. This divide suggests that UK shopping patterns remain mixed, although with demand continuing to be weak, retailers would be wise to remain cautious.”

Are you interested in reading more retail insights like this? Don’t forget to subscribe to the blog so you can be the first to know when we publish new industry reports.