The Order to Cash (O2C) process plays a crucial role in an organization’s relationship with its customers. While companies often get caught up in the processes before order placement, like marketing, optimizing the O2C process can sometimes get overlooked. You must streamline your order to cash process. Doing so allows you to provide a faster and improved customer experience.

This guide will take you through the entire O2C process from order placement through reporting and data management. By discussing best practices and challenges, we’ll show you how to implement the best order to cash process for your business.

Key Takeaways

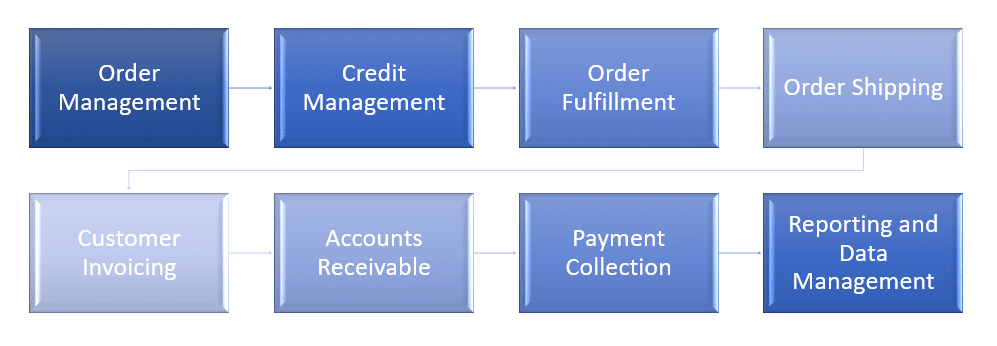

- The order to cash (O2C) process covers the full cycle from order placement through fulfillment, invoicing, payment collection, and reporting.

- Key stages include order management, credit checks, fulfillment, shipping, invoicing, accounts receivable, collections, and reporting.

- Optimizing O2C with automation and centralized systems reduces errors, accelerates payments, improves visibility, and ensures real-time communication across departments.

- Common challenges include inaccurate orders, manual invoicing, delays in collection, dissatisfied customers, and data security risks, all of which can disrupt cash flow.

- A streamlined O2C process strengthens supply chain efficiency, improves working capital, and enhances the overall customer experience.

What is the Order to Cash Process?

Essentially, the O2C or OTC process is the entire order processing system. Also called the O2C cycle, it is how your business receives, processes, manages, and completes orders. It begins from the time an order takes place and includes each step of the delivery and payment process.

The process even continues after the order is delivered and payment is made. By optimizing the cash process, you can define your success as a company. It will lead to better relationships with customers and eliminate inefficiencies.

Technology is vital for the modern O2C process. Automation of your business processes can lead to accurate, real-time information. By automating your business processes, you ensure that each department is working with the most up-to-date information. Software can now track your O2C process from the time an order is made until it is delivered to your customer’s door.

Importance of O2C Process

There are many reasons companies should strive for an excellent O2C process. One reason is that it has a cascading effect across the organization. It has direct links to your supply chain management, inventory management, and workforce.

The processes during the order-to-cash process also determine your company’s cash flows. Invoicing and accounts receivable functions need to be functioning properly for your cash cycle to flow smoothly. Decreasing the cycle time between when accounts payables are due and payment for goods and services is made, helps your business maintain a positive cash flow.

Optimizing the process eliminates inefficiencies within your business processes. It can eventually result in having more working capital, fewer bottlenecks, and higher customer satisfaction. It can also reduce order to fulfillment time.

Process

The O2C process starts from the time an order is made to when any final reports are generated. This section will go over each step in this process and what they should entail. By the end, you should have a basic outline of the workflow of the order to cash process.

Order Management

The first step in the process deals with customer orders. Automating your order management system can optimize your ecommerce business. Customers can make their order and your solutions automatically alert the relevant departments. Your available inventory will be reduced, and your order processing system will alert the shipping department.

If you have manual order entry, you should double-check the items or services to ensure accuracy. The order should be sent out to all the relevant departments with a date by which the O2C process up until delivery must be done. Also, notify the customer that you have received their order and the date they should expect it to be fulfilled.

This step is arguably the most important. It is vital that the orders are accurate, and that the customer gets verification that the order has been placed. Any errors at this point will create problems with every other step in the process. The notification of other departments is equally important. For example, if the order is not sent to the shipping department, the item might be delivered to the customer later than promised.

Credit Management

Credit management reduces the chance that you will run into cash flow issues later on in the process. Especially if you engage in B2B ecommerce, you may give a line of credit to your customers. First-time customers should be approved before being able to order goods or services. Automated systems can take care of this process for you and will send more complicated cases to finance personnel for review.

Order management software will automatically send pre approved customers to the fulfillment stage. It won’t require any further input by the customer, and accounts receivable should receive an update that an order has been made. You can use SAP credit management to complete this process of credit approval and credit confirmation automatically.

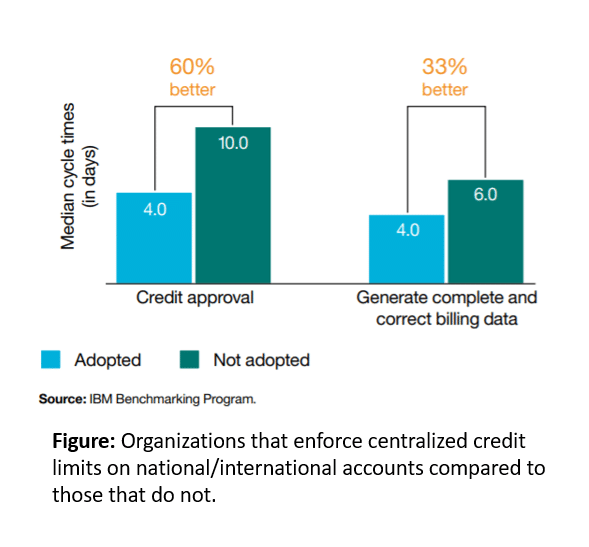

It is also important to centralize your credit management. Centralized systems improve efficiencies and promote better customer service by consolidating credit operations.

The figure below shows the median cycle times for organizations that enforced centralized credit limits. It shows that companies that adopted such limits saw a 60% faster cycle time to approve credit. This resulted in a 33% faster cycle time to generate complete and correct billing data.

Order Fulfillment

At this stage, the order is prepared for shipment, or the service appointment is scheduled. If you automate your business processes, the shipping or service department should already know that they have an order.

If the previous stages are carried out correctly, inventory should be available to fulfill the order. Proper supply chain management makes sure that inventory is kept up-to-date and accurate, so customers never have to wait on an order. If something is out-of-stock, it must be flagged immediately. The customer should then be notified and given the option to wait or cancel their order.

Order Shipping

This is the delivery of goods or services. If your company is shipping goods, some of this process can be automated. When an order is made, a shipping label can be generated, and then a notification will be sent to the customer and the appropriate departments when the items are shipped.

For example, great warehouse management will track this shipping for both outgoing goods and returns. You will know where your products are, even when they are not within the walls of your warehouse.

This step can be the most unpredictable. If you are shipping goods, chances are you are relying on another company for delivery. While you can estimate shipping times, packages can get lost or stolen.

Have a system in place to flag deliveries that are taking longer than expected and follow-up with the shipping company and the customer. This way, you will know why the package is delayed and you can provide the customer with an updated delivery date.

Customer Invoicing

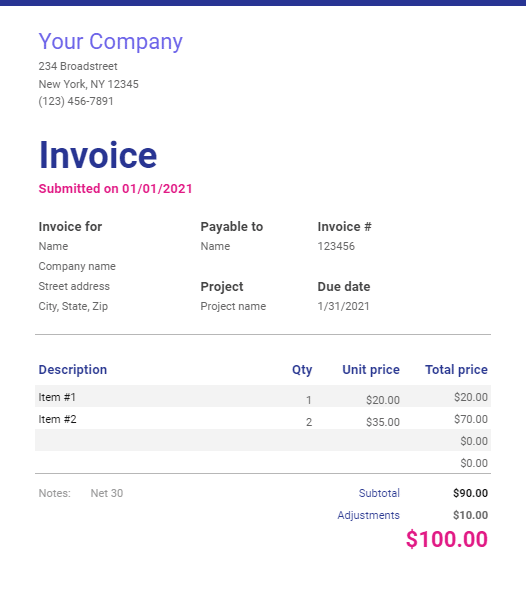

Unless payment was received when the order was placed, an invoice must be made and sent to the customer. Do not rely on accounts receivable to manually check for fulfilled orders. Your accounts receivable department should be notified when the order is made and when it is shipped.

If you automate this process, then the system should generate the invoice automatically. That way, the invoice just needs to be checked for accuracy before being sent electronically or by mail to the customer. If you need to send this invoice to other departments, there is software you can use to share documents online.

Invoices should be consistent and clear to both your accounting department and your customers. It should be itemized and have clear terms for payment. For example, if you expect your customer to pay within 30 days after the date on the invoice, it should clearly state Net 30.

Accounts Receivable

Your accounts receivable department should then keep track of the invoice until payment is made. Automated systems will alert you to outstanding invoices at pre-set times before they are overdue.

This allows the department to review these invoices to determine if any errors are delaying payment. For example, a customer may not pay an invoice due to pricing errors. Also, make sure that the invoice address is correct. Some businesses or customers may have billing addresses that do not match their shipping addresses.

This is also an opportunity to check to see if there was any breakdown in the process up to this point. Before a customer fulfills payment, you want to ensure there were not any errors made. When an error is found, contact the customer as soon as possible. For this, your company will need a reliable business phone system. Look into alternatives to Mitel PBX. One great option is to use Dialpad , a VoIP service provider similar to RingCentral.

Payment Collections

Collecting and monitoring payments can be tricky. The first line of defense is having alerts that notify you when customers make payment. Your company can run into serious customer experience problems if customers are asked for outstanding balances they have already paid.

The solution to this potential problem is putting in place several processes to prevent it. If you have a digital operations platform or an ERP system (Enterprise Resource Planning system), it should automatically update all relevant departments.

Your system will make the proper entry in the general ledger and make sure the sales order is marked as paid. It will also stop all reminders to the customers and the accounts receivable department.

Reporting and Data Management

This last step is almost as important as the first. The goal of your company is to optimize the entire process from ordering to payment collection. The only way to monitor that process is through reporting and data management. If you use high-end software, then most of these reports will be generated for you.

Your management team can use metrics from this data to determine how smoothly the O2C process is going. For example, you can determine the days sales outstanding (DSO) which measures the average number of days that it takes to collect payment after a sale.

These reports can be shared during virtual meetings to discuss your O2C process with your team members. Look into the best screen sharing apps, so you can go over these reports with your team in real-time.

Challenges to the O2C Process

While the process may seem straightforward, it involves a lot of moving parts. Failure in one step can result in a breakdown in the cycle. The set of business processes involved requires a great deal of attention and all departments working together. Some things to watch out for are:

- Inaccurate sales orders

- Time-consuming manual invoices

- Dissatisfied Customers

- Delays in Collection

- Data security

Inaccurate orders mean that at one point in the process, the order must be redone. This will cost you precious time. Manual invoicing also takes time and has a greater potential for errors. If all of this leads to wasted time, there will be a delay in collections. The delay can complicate other business processes like accounts payable, payroll, and acquisitions.

Your company also should keep an eye on customer satisfaction. Any hiccups in the O2C process can diminish the customer experience. To keep an eye on this, use customer relationship management (CRM) software to manage your company’s relationship with its customers. In the same vein, data breaches can also lead to dissatisfied customers, so make sure to take your retail cybersecurity seriously.

Tips

It can be difficult to navigate how to best implement an O2C process. Here are some tips to help you get started.

Establish Standards

This creates consistency in your company. Also, the more you do something, the better each department will get at implementing it. By doing something the same every time, your team will become more efficient and be able to target any process that isn’t working towards the optimization of your order to cash cycle.

Use AI and Other Emerging Technology

The use of technology is vital for a fully functioning O2C process. Using these systems will also help you integrate all your business processes in a centralized hub. This ensures all areas of your company are always communicating and updating each other in real-time.

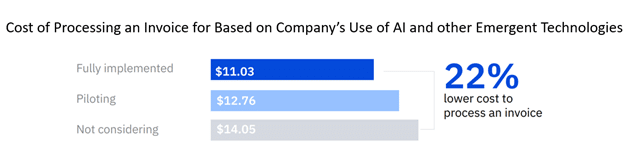

Implementing these technologies will also save you money. IBM found that companies that used AI and other emergent technologies saved 22% per invoice.

Regularly Monitor and Evaluate

Always take the time to monitor and evaluate your O2C process. Technology is always changing and what works now, may not be the best way to do things in the future. Also, there is always a place for improvement.

Create space in your company for departments to suggest ways to improve this process. You can also use things like project management software to monitor how your order to cash process is working on the project level.

Conclusion

Optimizing your order to cash process will impact every facet of your business. It lies at the center of what makes your business profitable. Paying close attention to each step in the O2C cycle will save your company time and money, and will lead to overall higher customer satisfaction.